Good news for Utah teachers.

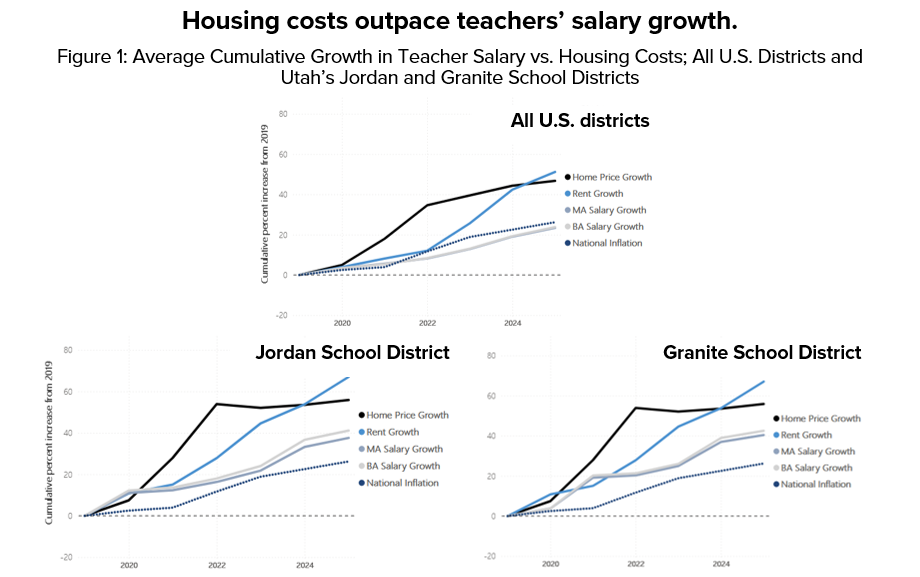

A new National Council on Teacher Quality study finds that “Between 2019 and 2025, housing costs increased by 47–51% on average, far outpacing the average 24% growth in beginning teacher salaries.”*

How is that good news? Well, the study’s two Utah school districts, Jordan and Granite, seem to be doing a bit better than the nation. While Utah’s home price growth and rents outpace the national average, so do teacher salaries. See Figure 1.

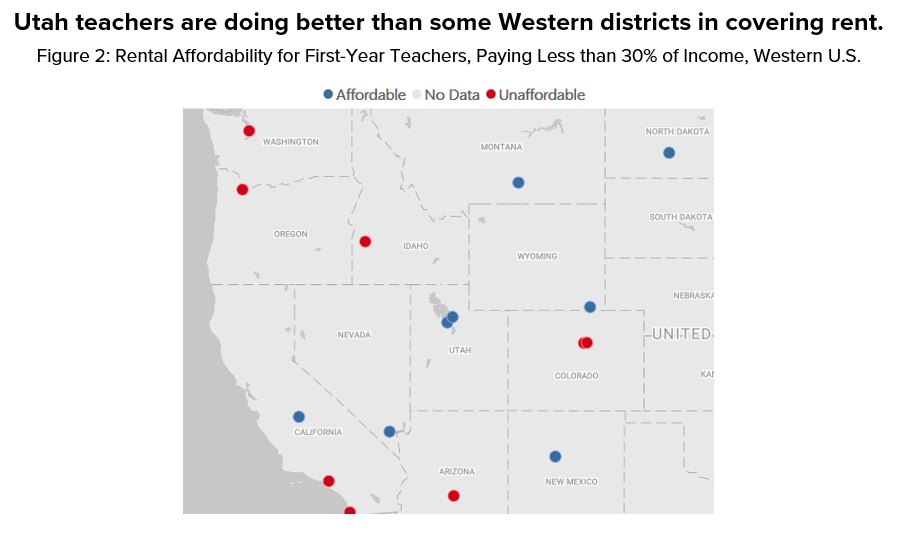

Further, while “new teachers can’t afford to rent a one-bedroom apartment in about half of the districts in [the] sample, regardless of whether or not they hold a master’s degree,” this is not the case in Jordan and Canyons. See Figure 2.

For the rental market, the researchers define an unaffordable district as one in which one-bedroom rental costs exceed 30% of their salary. However, it is important to keep in mind that some first-year teachers might have children and need more than one bedroom.

Further, rental unaffordability seems to be catching up to homeownership unaffordability. (Again, see Figure 1 showing rent growth surpassing home price growth.)

Finally, the report shows that homes were unaffordable in many districts in 2019, even for mid-career teachers. By 2025, they have become much more unaffordable.

So, perhaps the “good news for Utah teachers” should be “relatively okay news…”

Source: Katherine Bowser, “Priced out: The growing challenge of teacher pay and housing costs,” National Council on Teacher Quality, May 8, 2025, https://www.nctq.org/research-insights/priced-out-the-growing-challenge-of-teacher-pay-and-housing-costs/.

* Please note: Recent household incomes were only about 20% higher than in 1985, while home prices had increased by 90% (adjusting for inflation). Obviously, this does not account for the fact that the 30-year fixed-rate mortgage was 13% in 1985. Once you account for that, you find that the mortgage payment in 2024 is only 3% more expensive (adjusting for inflation) while incomes are 20% higher, meaning that housing today is relatively less expensive than 1985, even though home prices are 90% more expensive. See https://www.utahfoundation.org/reports/housing-affordability-2024-priorities-brief-1/.

Categories: