Utah estimates the state’s future tax revenues using a consensus approach. It is undertaken by the Utah’s Revenue Assumptions Working Group – a collection of economists and experts from the Governor’s and Legislature’s staff, the State Tax Commission, and state academic institutions and departments.1 This approach is not the way all states estimate revenue.

In other states, such as New Jersey, the Governor’s staff creates one revenue estimate and the legislature’s staff creates a differing revenue estimate. This has led to clashes between the differing projections as the executive and legislative branches argue first over which revenue projections are correct only then arguing over how to spend the money. These revenue-projection arguments can be even more tense when the executive belongs to one party and a majority of the legislature to another, which happened in nearby Montana in 2011.2

Alternatively, in some states either the legislative or executive branch makes the sole determination, leaving the other branch out of the process completely. In 2013, the New Hampshire Governor created a panel to estimate revenues that left out the state legislature. As a result, the legislature decided they would do their own revenue estimates.3 As of 2014, 10 states have revenue projections created just by the executive branch, including neighboring Idaho. While there may not be arguments over the estimated revenues, it may mean that actors who do not see themselves as having a stake in the process are be less likely to support its conclusions.

Another approach, which lands somewhere between sole determination and Utah’s consensus approach, is employed by Nevada. Its Economic Forum forecasts revenues. Created by the Nevada Legislature, the forum has five governor-appointed members, though with the Majority Leader from one house and the Speaker from the other each nominating one member.4

Some research has shown that consensus revenue estimates are not necessarily more accurate.5 Further, like all methods, the consensus approach is not free from political pressure. However, consensus estimates have a role in making sure that everyone can get behind the estimate and fully engage in discussing how to spend state revenues, rather than spending time debating how much state revenues should even be expected.6

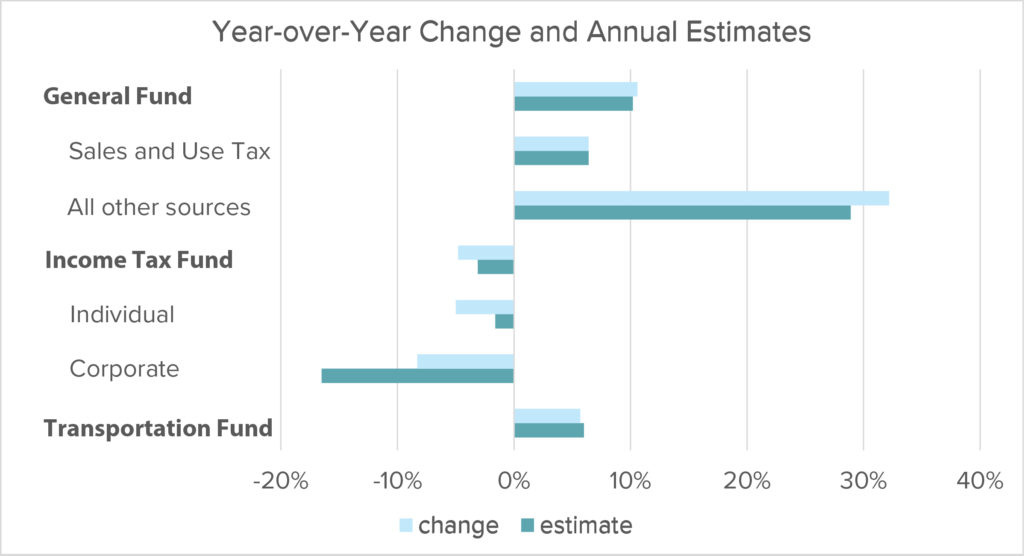

The most recent revenue report of the fiscal year is interesting in some ways. As of the end of April – which includes the income tax filing day – Utah had collected less income tax than the previous year. This is an interesting turn of events considering that as of March the state had collected 15% more in income taxes than the previous year. The state is now looking at a deficit of around $200 million – plus or minus a couple hundred million. Overall, this puts the expected income tax revenue below the consensus estimates of negative 3.1% for the fiscal year. Conversely, the sales tax projected growth is spot on at 6.4%.7

In upcoming Revenue Report releases we will examine a host of issues, such as types of funding, components of revenue, and how Utah projections compare to eventual outcomes. Read about Utah’s Projections Process and an Income and Sales Tax Surprise in previous releases.

- Governor’s Office of Planning and Budget, 2023, “Utah’s budget process,” https://gopb.utah.gov/budget-operations/utahs-budget-process/ ↩

- Charles S. Johnson, Missoulian State Bureau, September 27 2011, Governor’s budget director debunks gloomy budget forecast, https://missoulian.com/news/article_5f36cde6-e868-11e0-8177-001cc4c002e0.html ↩

- Bailey, Steve, et al., 2015, “Managing volatile tax collection in state revenue forecasts,” Pew Charitable Trusts, https://www.pewtrusts.org/en/research-and-analysis/reports/2015/03/managing-volatile-tax-collections-in-state-revenue-forecasts ↩

- Nevada Legislature, Economic Forum, https://www.leg.state.nv.us/division/fiscal/economic%20forum/index.html ↩

- Krause, George A., James W. Douglas, 2013, “Organizational structure and the optimal design of policymaking panels: Evidence from consensus group commissions’ revenue forecasts in the American states,” American Journal of Political Science, https://search.ebscohost.com/login.aspx?direct=true&db=aph&AN=84577712&site=ehost-live ↩

- Mikesell, John L., and Justin M. Ross. “State revenue forecasts and political acceptance: The value of consensus forecasting in the budget process.” Public Administration Review, vol. 74, no. 2, 2014, pp. 188–203. JSTOR, http://www.jstor.org/stable/24027685. ↩

- GOPB and LFA, Monthly State Revenue Snapshot, May 15, 2023. ↩

Categories: