Welcome to the first Revenue Report from the Utah Foundation. As state taxes and government spending have always been among Utah’s top ten concerns in Utah Foundation’s “Utah Priorities Project,” we thought it would be helpful to provide a monthly discussion on Utah’s state revenues. In this month’s discussion we highlight the income and sales tax surprise – how revenue collections are well above expectations.

The Utah State Tax Commission periodically releases a revenue snapshot of tax and fee collections, and the Office of the Legislative Fiscal Analysts and the Governor’s Office of Planning and Budget compare those numbers with the previous revenue forecasts.

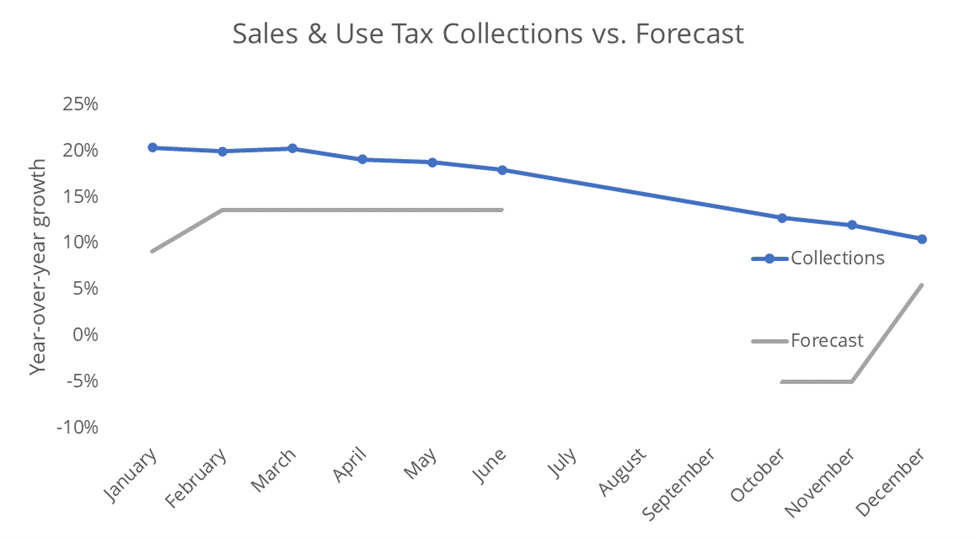

Revenues collected from sales tax continue to be much higher than the forecast. Year-over-year sales tax collections deposited in the General Fund stood at 18.0% in June and 10.5% in December. As one might expect given the economic slowdown, sales tax collections are decelerating. However, revenues are still well above the forecast – updated in late November from a 5% decline to a 5.5% increase.

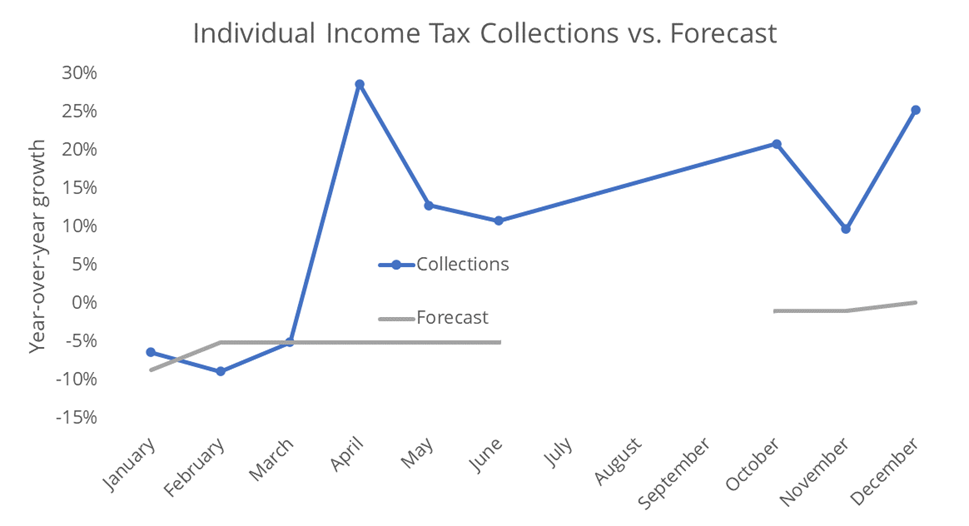

Individual income tax collections also continue to exceed expectations by a wide margin. Collections were quite low in early calendar-year 2022, followed by an expected jump in April due to tax filings. These collections are substantially higher than revenue estimates that were adjusted upward in late November from a 1% decline to a 0.1% increase.

The State will be re-forecasting revenues after one more monthly collections report – due in the middle of February. Legislators will consider these numbers before making final budget decisions for the 2023 General Session. Interestingly, if the current growth rates were to hold throughout the remainder of the fiscal year (June 30th), the state would end the year with $1.9 billion more than forecasted.

In this edition we highlighted how actual revenues can sometimes far exceed expectations. This can have a real impact on how the state spends its money, which we will dive into in further detail in future editions of the Revenue Report.

—-

This post was written by Utah Foundation staff as well as Utah Foundation board member Thomas Young.

—-

Note: There has been some concern that part of the healthy revenue picture stems from the more-risky net final payments which are mostly collected when individuals and businesses make their final tax year payments in April. That is partially true, but most of the individual income tax picture – and collections – should really be viewed from the withholding perspective. And withholding is running at 7.6% year-over-year, not much different than the prior month’s 7.8%.

Categories:

Comments:

4 Responses to “The Revenue Report: Income and Sales Tax Surprise”

Ryan Barrett

Can you make the data publicly available via AWS, or some other cloud infrastructure to allow outside entities (such as myself) to build some forecasting models?

Shawn Teigen

Hello Ryan. Sorry for the late reply… We might be able to. Reach out to Christopher — [email protected]

Thanks

Greg Duerden

Question: Why the hole in the forecast from June through September ??

Shawn Teigen

Great question. Simply because the data weren’t published for those months.