Growth and prosperity are likely to be serious issues facing Utahns over the coming decade. We can see this in the drivers of recent rent increases along the Wasatch Front. Further, there is a good chance that current financial market conditions will sharply push up rents again in the future.

Rents on the Increase

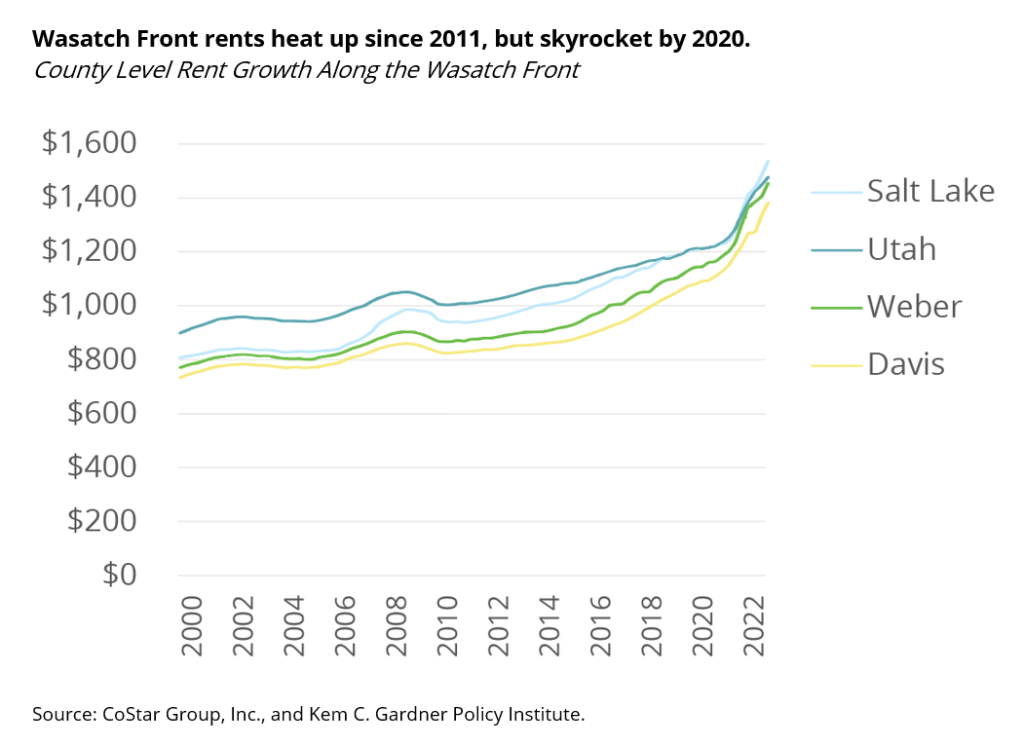

Rapid rent increases are neither entirely recent nor purely COVID-related – as illustrated by the rent increases seen between 2010 and 2020. The Wasatch Front market between 2010 and 2020 was heating up with annual rent increases during this period often exceeding the average inflation rate of 1.7% – after having fallen somewhat during the Great Recession.1

Construction Shortfalls

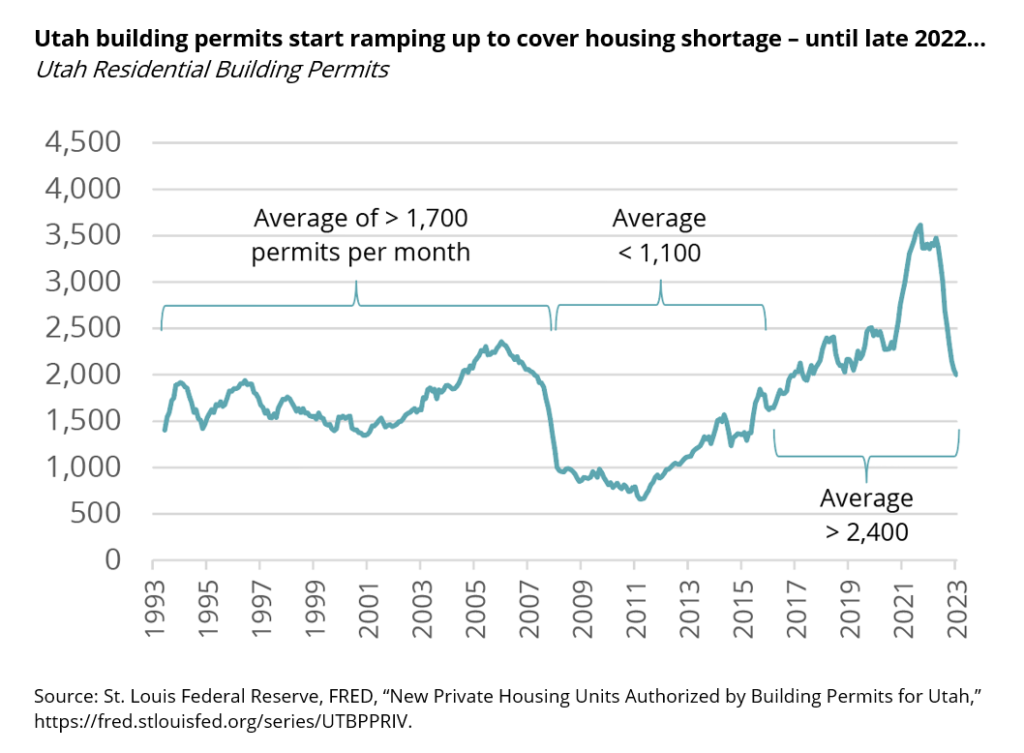

The cause for those rent increases is likely fallout from the 2008 financial crisis. Even though Utah’s population was growing at an above average rate between 2006 and 2013, residential building permits issued dramatically declined and remained low between 2008 and 2016. In fact, residential building permits issued between 2008 and 2015 averaged less than 1,100 per month compared to over 1,700 per month during the previous 15 years. Between the 2011 low and 2017, Utah households increased faster than housing units were produced – which meant that Utah’s housing deficit increased over the period. In fact, an average of 2,400 residential building permits issued per month between 2017 and 2023 was required to reduce Utah’s housing deficit from over 56,000 in 2017 to roughly 31,000 in 2022.2 Obviously, this process has been cut short since early 2022 with the Federal Reserve raising interest rates quite aggressively.

What Lies Ahead

This all means that Utah’s ongoing housing deficit will continue to put upward pressures on housing costs. In fact, present financial conditions hindering robust construction seem to ensure as much. Assuming that Utah’s population continues to rise through this process of monetary tightening, when interest rates return to normal Utah might see another boom in housing and rental prices. Utah may have only witnessed the first of at least two rental price and housing market spikes in the 2020s.

1 Utah Foundation calculations.

2 What’s ahead for Utah’s Home Building Boom, James Wood, https://www.scribd.com/document/583062927/What-s-Ahead-for-Utah-s-Home-Buiing-Boom#from_embed.

This Significant Statistic post was written by John Salevurakis and Shawn Teigen.

Categories: