How will the 2015 Utah Legislature’s increases on gas and property taxes affect Utahns? It may bump our respective state and local tax burdens ranking up just a bit. While in 2012 Utah saw the lowest tax burden that we have in at least 20 years, a new analysis by Utah Foundation’s Christopher Collard shows that downward trend may stabilize or reverse by 2016 and 2017.

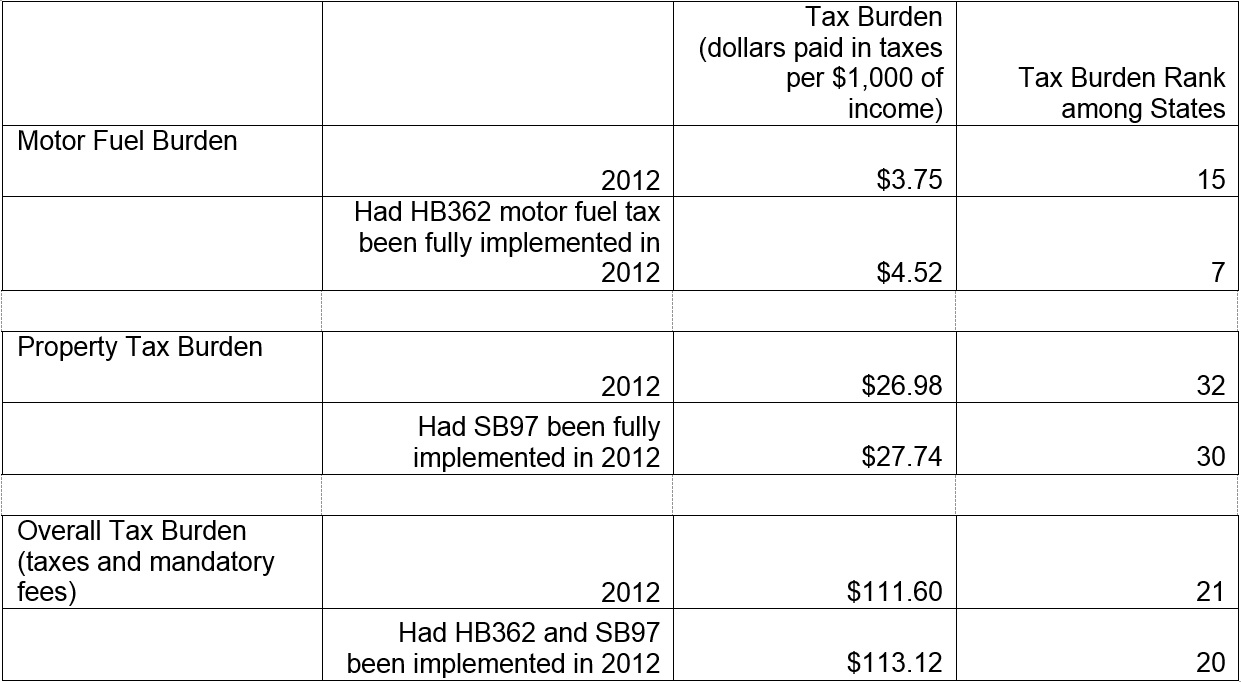

This table is simply an estimate. The 2016 data (for the first year of implementation) and the 2017 data (for the first full year of implementation) will not be available until 2019 and 2020, respectively. However, if HB362 and SB97 had been fully implemented in 2012, Utahns’ tax burden would have bumped up by one place nationally, from 21st to 20th – or from $111.60 per $1,000 of personal income to $113.12.

What did HB362 and SB97 do?

HB362 converts gas and diesel taxes into a sales tax and results in an increase in transportation revenue of about $75M by 2017. According to the fiscal note on the bill, “for an individual/business driving 12,000 miles per year with a car that gets 25 miles to the gallon, the tax increase is $24 in FY 2017.” It also results in higher alternative fuel taxes and could result in voter-approved county sales taxes.

SB97 increases property taxes for individuals and business, which will result in $75M for schools. According to the fiscal note on the bill, homeowners in average homes (valued at $250,000) could see an increase of “$48 in FY 2016 and $47 in FY 2017.”

Categories: