Among the most basic – and contentious – components of water management is how we pay for water, with property taxes versus user fees at the heart of the debate. Utah Foundation’s new Paying for Water Series will examine the key areas of concern related to this debate, including conservation, fairness and practical considerations. The series builds on Utah Foundation’s in-depth research into the many dozens of water providers serving residents of the state.

The first report in the series provides an overview of Utah’s waterscape and the structures and challenges surrounding it and provides the necessary background on water use, water providers and users, and water finance in Utah.

Paying For Water Series

This series contains four parts as outlined below.

• Entire Report: Paying for Water: How Water Finance Impacts Utah

• Executive Summary: Paying for Water: A Brief Summary of the Series

• Part 1 – Background: High and Dry: Water Supply, Management and Funding in Utah

• Part 2 – Conservation: Drop by Drop: Water Costs and Conservation in Utah

• Part 3 – Fairness: Who Gets the Bill? Water Finance and Fairness in Utah

• Part 4 – Practical considerations: Getting Clear on Water: Practical Considerations in the Tax Versus Fee Debate

There may not be a one-size-fits-all approach in Utah. Utah’s 308 water providers vary widely in their tiered rate structures, size and funding mechanisms. Per capita water use also varies widely, depending on climate, geography and community characteristics.

Most of Utah’s providers do not directly use property taxes, even though they can. However, seven of Utah’s 15 largest water retailers do use property taxes, as do all five of the largest wholesalers. As a result, more than 90% of Utahns live within the jurisdiction of at least one water provider that collects property taxes. While the national prevalence of supporting water rates with tax revenues is not clear, it is clear that there are many water utilities that manage both with and without property taxes supporting water rates.

Therefore, the question may not be about what other states are doing, but what approaches will lead to the best outcome for Utahns.

KEY FINDINGS OF THIS REPORT

- When it comes to water policy, Utah has a complex range of stakeholders, including a variety of water users and beneficiaries, as well as at least 308 public water suppliers.

- Because Utah is both one of the fastest growing and driest states in the nation, the challenge of water management is a pressing matter.

- Utahns divert more than 5 million acre-feet of water for annual use, even though only 3.3 million acre-feet is available for use, meaning that a significant portion of Utah’s diverted water is reused, rather than simply consumed.

- Less than 20% of the total diverted water is distributed through public utility systems. Of this water, residential users consume more than two-thirds – mostly for outdoor purposes.

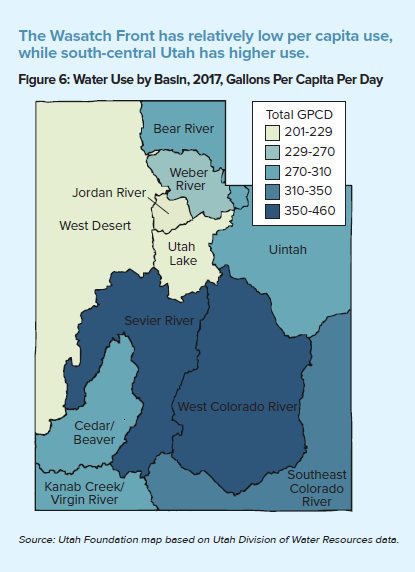

- Per capita water use from public utility systems varies widely based on climate, geography, economy and culture. The Wasatch Front has relatively low per-capita use, while south-central Utah has relatively high use. (Agricultural water use falls outside of the public systems. The per capita numbers reflect potable and secondary residential, institutional, industrial and commercial water only.)

- In surveying the tiered rate structures of water providers across the state, Utah Foundation found a wide variety of approaches.

- While it is unclear how many water providers outside Utah use property taxes alongside water rates, there are successful examples of both types of water providers: those that use property taxes to lower water rates and those that do not.

- Most Utah water providers have chosen not to directly impose property taxes; however, because of overlapping jurisdictions and because some providers are far larger than others, more than 90% of Utahns live within the jurisdiction of a water provider that collects property taxes.