Utah ranks among both the nation’s driest and fastest growing states. Water governance approaches that ensure sufficiency of affordable, quality water into the future is a major concern. Utah Foundation’s series of water reports seeks to fully explore the issue of how we pay for that water.

Water finance impacts fiscal stability, cost, transparency, and accountability in different ways. As policymakers plan Utah’s future, they must be cognizant of how today’s choices on water finance can impact the availability and quality of water now and in the future.

Paying For Water Series

This series contains four parts as outlined below.

• Entire Report: Paying for Water: How Water Finance Impacts Utah

• Executive Summary: Paying for Water: A Brief Summary of the Series

• Part 1 – Background: High and Dry: Water Supply, Management and Funding in Utah

• Part 2 – Conservation: Drop by Drop: Water Costs and Conservation in Utah

• Part 3 – Fairness: Who Gets the Bill? Water Finance and Fairness in Utah

• Part 4 – Practical considerations: Getting Clear on Water: Practical Considerations in the Tax Versus Fee Debate

While water rates are less stable than property taxes, they are more stable than other revenue sources, such as sales taxes. The fact that so many water providers both nationally and within Utah do without property taxes illustrates the feasibility of relying on water rates alone. Water providers can protect against revenue instability by building larger reserves or possibly through decoupling to create flexible water rates.

KEY FINDINGS OF THIS REPORT

- While water rate revenues are not as stable as property taxes, they are among the most stable relative to other possible revenue streams commonly used to support revenue bonds.

- Rainy day funds and decoupling of water rates from sales volume can help address budget volatility.

- While it stands to reason that property tax revenues might help push credit ratings higher and thereby make the overall cost of water cheaper, it is only likely to be the case to a marginal degree.

- Market distortions created by using property taxes for wholesale water may increase the overall cost of water.

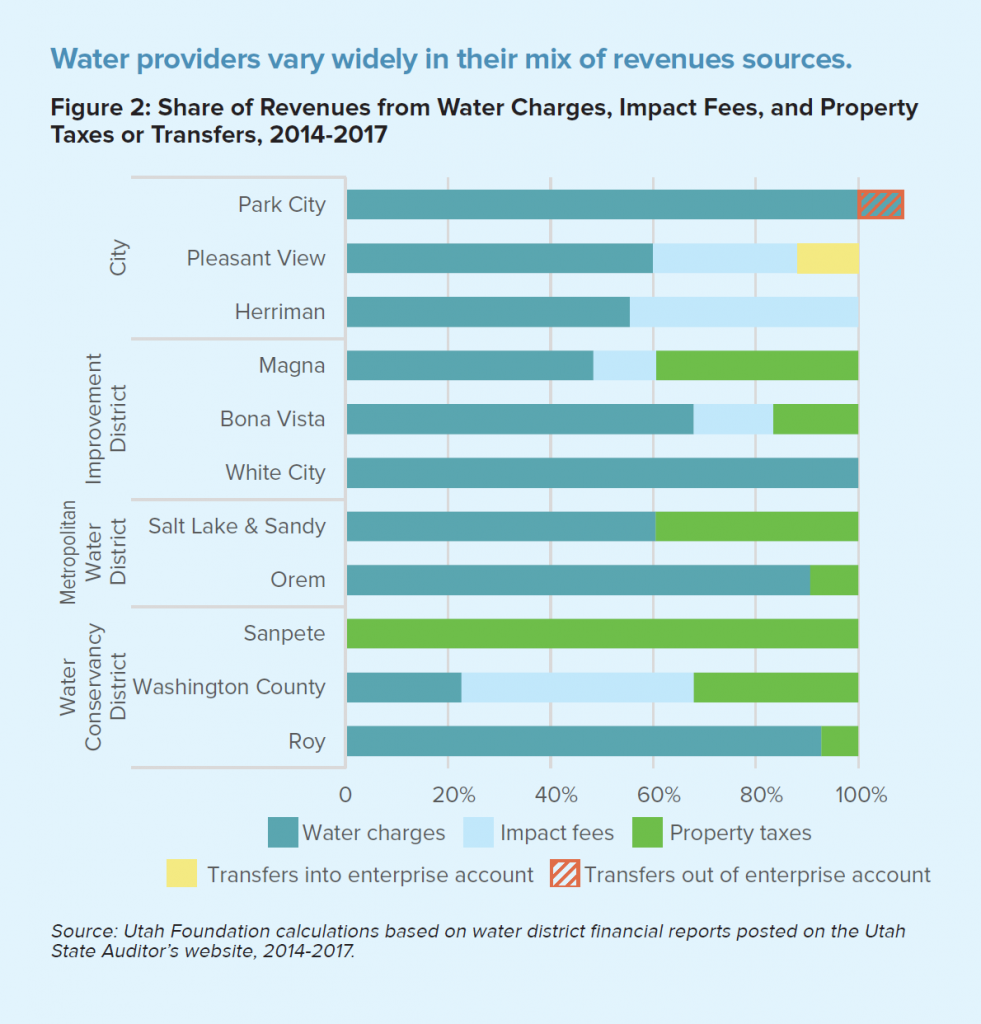

- A mix of revenue sources allows for more local flexibility by allowing water providers to use the property tax as needed and to counterbalance drawbacks in water rates.

- A full reliance on water rates tends to provide stronger cost transparency because consumers can turn to a single source of information for their use and cost: monthly water bills.

There are reasonable claims that property taxes may allow for cheaper borrowing. However, rating agencies indicate that the difference is marginal. Meanwhile, with reduced reliance on property taxes, increased conservation induced by higher water rates could also lower costs by deferring larger investments until a larger population is present to share in those costlier developments. Furthermore, property tax collections by water wholesalers may create price distortions that ultimately raise the cost of providing water.

Although the range of possibilities for structuring water rates allows water providers significant flexibility, the option of using property taxes adds flexibility. The populations served, geographies, local preferences and local economies vary among water providers, and property taxing authority allows an additional tool for providers to determine the best way to deliver services.

Ultimately, there are tradeoffs in terms of revenue stability, consumer costs, provider flexibility, and consumer transparency and representation. These tradeoffs must be weighed alongside the conservation and fairness issues discussed in Parts 2 and 3 of this series to determine the future of Utah water revenue policy.