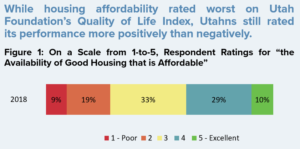

Housing affordability is an issue of increasing concern to Utahns. For the first time since Utah Foundation initiated its Community Quality of Life Index survey in 2011, the availability of quality affordable housing was the worst-performing factor on the index. In addition, when asked what could most improve respondents’ communities as a place to live, 13% mentioned improving housing affordability, second only to traffic conditions.

Housing affordability is an issue of increasing concern to Utahns. For the first time since Utah Foundation initiated its Community Quality of Life Index survey in 2011, the availability of quality affordable housing was the worst-performing factor on the index. In addition, when asked what could most improve respondents’ communities as a place to live, 13% mentioned improving housing affordability, second only to traffic conditions.

Interestingly, however, when asked whether their own housing was affordable, only a small minority indicated that it was not.

Housing costs tend to be a household’s largest single expense. And in Utah, housing prices have increased sharply during the past five years; the median sales price of a home rose from $207,000 in 2013 to $298,950 in 2018. While homebuyers have seen a 44% increase in prices, renters are also seeing higher costs. Median rents in Utah increased from $851 in 2012 to $986 in 2017.

This policy brief looks closely at three housing affordability questions in the Quality of Life Index survey. The brief is a supplement to the full report, Utah Foundation Quality of Life Index: Measuring Utahns’ Perceptions of their Communities, Personal Lives, released in September 2018.

Key Findings of this Report

- Housing affordability has the lowest rating in the 2018 Community Quality of Life Index.

- Of the 20 aspects on the index, housing affordability had the largest decline.

- Housing affordability in general is of greater concern for older Utahns than younger ones.

- When asked whether they felt their personal housing costs were affordable, only 12% of respondents said no. However, in Salt Lake County, that number was 20%.

- Respondents with lower incomes, those who are renters and those who live in Salt Lake County were more likely than other Utahns to feel that their own housing is unaffordable.

- When adjusting for inflation, Utah homeowners’ monthly costs have decreased by 10% since 2007, while renters’ costs have increased by 14%.

- More people gave a poor rating to “how affordable housing is for individuals in all income levels” than gave an excellent rating. However, nearly half of the respondents gave neutral responses.

- Those who are not religiously affiliated, renters and residents of Salt Lake County were more likely to be concerned about housing affordability across income levels.

- When compared to other large metros in the west, Utah’s housing costs are relatively favorable.