Property tax is one of the legs of Utah’s “three-legged stool” of tax revenues, along with the income and sales taxes. During the nineties and early aughts, the property tax was the smallest revenue generator of the three. However, with the 2008 income tax reform and the erosion of sales tax revenues, the three have been more equal, with the property tax bringing in approximately $3.3 billion in 2016, compared to $3.6 billion for income tax and $2.7 billion for sales tax.

The largest portion of property tax revenues come from taxes on primary residences, followed by commercial real estate. These revenues are used for a wide variety of governmental services, from K-12 education to mosquito abatement.

While the property tax is among the most time-tested forms of taxation, citizens and policymakers have recently revisited the particulars of Utah’s approach. Specifically, they are examining ways tax policy might be modified to produce greater revenues for K-12 education. They are also looking to ensure that the current property tax structure does not have an unduly negative affect on local government revenues.

This report helps readers understand the property tax. To do so, it explains the current workings of the property tax from a statewide perspective, details the various purposes of a property tax and looks at potential changes. In light of recent concerns about school taxes and the state’s Truth in Taxation law, the report provides a special focus on those issues.

This is the first installment in Utah Foundation’s Utah Tax Policy Series. Subsequent reports will address sales and income taxes.

Key Findings

- Utah’s property tax burden ranks 34th among states. The tax burden has been stable over time, both in terms of income and its ranking among states.

- Utah’s Truth in Taxation law appears to have prevented property tax revenues from increasing as quickly as property values.

- Revenues for school districts and special and local districts statewide have increased faster than inflation and population growth combined. By contrast, cites and towns have only been able to match population growth and inflation while county revenues have grown even more slowly.

- Residential property has a much more favorable tax status than business properties. Not only do residential homes receive a 45% discount, but residential taxpayers are also exempt from personal property taxes.

- Residential properties still provide nearly half of all property tax revenues.

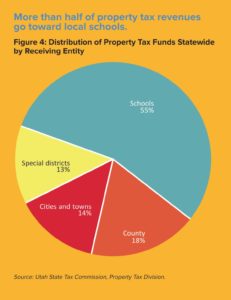

- More than half of all property tax revenues go toward public schools.