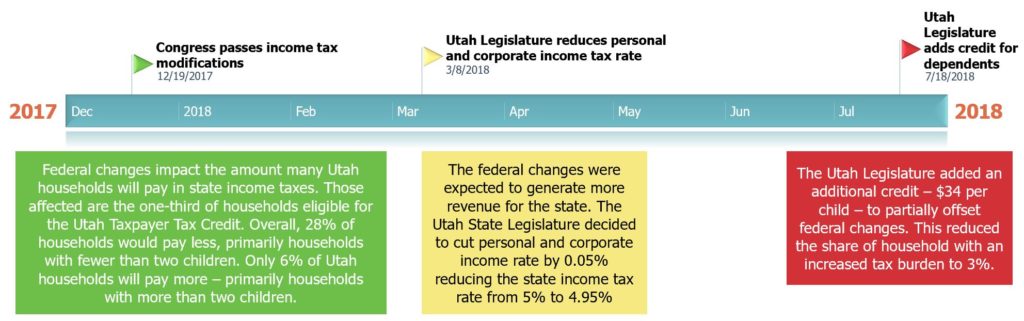

The past twelve months have been a wild ride for income taxes. Utah’s last major income tax reform took place back in 2008. Since then the income tax has seen relatively few changes. However, that changed at the end of 2017 when Congress passed a bill modifying the federal income tax. Because Utah’s tax system is linked to the federal system (which makes it easier for you to figure out your state taxes), those federal changes affected the amount many Utah households would pay in state income taxes. It affected Utah households eligible for the Utah Taxpayer Tax Credit, approximately one-third of Utah households – primarily those with incomes between $20,000 and $80,000.

Among these households, those with fewer than two children would end up paying less in taxes (27% of Utah households), while those with more than two children would end up paying more in taxes (8% of Utah households).

Overall, this change was expected to generate more revenue, so the Utah State Legislature decided to cut income taxes for everyone. As Utah Foundation pointed out in a March report, this change further benefited small families, higher income households and corporations – but at the expense of large families with low- and middle-incomes.

Following the release of Utah Foundation’s report, the change became more commonly understood. In a special session called to address the impact of federal changes on state revenues, the Utah State Legislature passed what has been referred to as a child tax credit that affects these low and middle-income households. This essentially provided a $34 tax credit for every dependent claimed.

Cumulatively, these changes have a positive or neutral impact on the majority of Utah households. Approximately 64% of Utahn households will not see a substantial difference. However, 31% will see a substantial decrease in state tax liability – nearly half of these households would expect a tax liability of $330-$375 lower. These are mostly single adults or couples with no children. Only 5% of Utah households are expected to see a substantial increase in their taxes. These consist of households with lower to middle incomes and larger families. Half of these increases range between $200 and $400.

To see how this affects your household, visit our 2018 income tax calculator.

Categories: